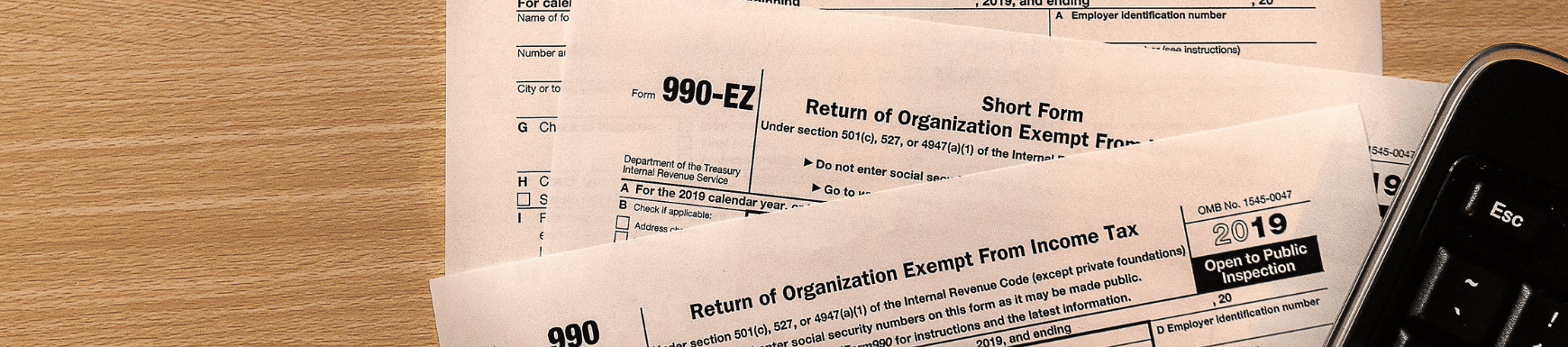

During tax season earlier this year, I had a chance to ask a few Unity Medical Center Foundation donors if they were familiar with the North Dakota Tax Credit for charitable giving. Most said no, so I thought it would be a good idea to explain it further in my column. It’s a great benefit for anyone who itemizes their charitable contributions on their tax forms.

Since the state Legislature signed it into law in 2011, individuals in North Dakota are eligible for a 40 percent state tax credit if they make a charitable gift of $5,000-$25,000 to a qualified endowment. Couples filing jointly would qualify for gifts of $5,000-$50,000. For example, if I gave $5,000 to a UMCF qualified endowment, I would receive a $2,000 tax credit from the state of North Dakota. The credit can be carried over for three additional tax years.

Businesses, estates, trusts and financial institutions may also benefit from the state tax credit. In their case, there is no minimum gift amount to qualify for the 40 percent credit, but the maximum credit is $10,000.

UMCF benefits from one qualified endowment: the Lynn D Ebert Memorial Fund for Unity Medical Center Grafton, held by the North Dakota Community Foundation. Any gifts given to this fund would qualify for the state tax credit.

Keep in mind that donors are also eligible for a federal tax deduction for charitable giving, which varies by tax bracket. This would apply to the $5,000 gift example mentioned above as well. So if you are in a 32 percent tax bracket, you may also receive a $960 federal tax deduction on that $5,000 gift, in addition to the $2,000 state tax credit. So you give $5,000 and get $2,960 back. The $5,000 gift only “costs” $2,040.

You can read more about this tax credit at www.ndcf.net/give/taxcredit.html. Please consult your tax advisor if you have questions about this.